1.0 Policy statement

As a Multi Academy Trust, dedicated to the education and well-being of our students across multiple schools, Beckfoot Trust recognises the significance of maintaining a responsible and transparent approach to expenses management. This Expenses Policy sets out a comprehensive framework for managing expenses, ensuring that all expenditure is conducted efficiently, ethically, and in compliance with the highest standards of accountability and transparency.

2.0 Scope and purpose

The purpose of this Expenses Policy is to establish clear guidelines for managing expenses in Beckfoot Trust. It aims to promote financial prudence, minimise unnecessary costs, and maintain a sound financial position while supporting the Trust’s mission of providing the highest quality education to our students.

This policy applies to all employees, Trustees and LSC members who are authorised to incur expenses on behalf of the Trust. It covers various expense categories, including travel, accommodation, meals, entertainment, supplies, and other business-related costs.

This policy has due regard to the following regulatory frameworks:

- HMRC exempt expense rules

- Academy Trust Handbook

This policy also links to our Trust policies on:

- Finance

- Multipay Card

3.0 Overarching principles

The overarching process for claiming expenses and the necessary documentation and approvals is summarised here:

- Payments for the personal expenditure in connection with authorised business can be made using the Beckfoot Trust expense claim form.

- Any purchase that can be made in advance must be done so through the purchase order system.

- Employees should make reasonable efforts to get the best value possible when purchasing items, food or travel tickets.

- Receipts for all expenses should be attached to the claim and wherever possible, a VAT receipt should be obtained.

- Expense claim forms must be signed by the claimant and approved and signed by the line manager or member of senior leadership team

- Expense claims by Headteachers must be authorised by the Chief Executive Officer (CEO) or Chief Operating Officer (COO).

- Authorised claims should be submitted to the finance team via email ([email protected]) along with scanned copies of receipts.

- All claims should be submitted within one month of the event. Claims that are submitted later than this will only be paid if an employee can show adequate justification for the delay.

- The purchase of classroom equipment and items must be completed using the purchase ordering system and paid for directly by the school.

- Claims which are not approved will be returned for the claimant to seek approval.

- The submission of false claims will be treated as a serious matter and may lead to disciplinary action.

- Claims adhering to this policy will be paid without the deduction of income tax as this policy complies with HMRC exempt expense rules. However, it is the claimant’s responsibility to ensure payment for any due tax is made arising as a result of individual circumstances.

- Mileage expenses may be paid via payroll or directly by the central finance team.

4.0 Responsibilities and arrangements

4.1 Private vehicle

The Trust’s Financial Regulations require that travel costs be cost-effective, car users should not therefore automatically use their cars for travel but should ensure that public transport is not more convenient or cheaper.

4.1.1 Mileage is paid at the maximum amount allowed by HMRC, currently 45p per mile for cars and vans and 24p per mile for motorcycles for the first 10,000 business miles. This applies to petrol, diesel, hybrid and electric vehicles.

4.1.2 Speeding or parking fines will never be reimbursed.

4.1.3 Employees are encouraged to carpool where possible.

4.1.4 Mileage claims must have a VAT receipt for fuel used to allow the Trust to reclaim VAT. The claimant is responsible for attaching the receipt and the line manager is responsible for checking the receipt is valid prior to submitting for payment. Where a VAT receipt Is not received, VAT will not be reclaimed.

An appropriate receipt must:

- be dated before the date of the journey claimed for

- show the amount of fuel purchased in litres

- show the name of the fuel supplier and their VAT registration number

- account for at least 20% of the total amount of the mileage claim

4.1.5 If several low mileage claims are submitted, a single receipt showing fuel purchased to cover all the miles claimed is sufficient.

4.1.6 In the event of an employee travelling directly to (or from) a meeting or any other non-school location the mileage claimed should be the lower of the distance:

- from home to the destination

- school to the destination

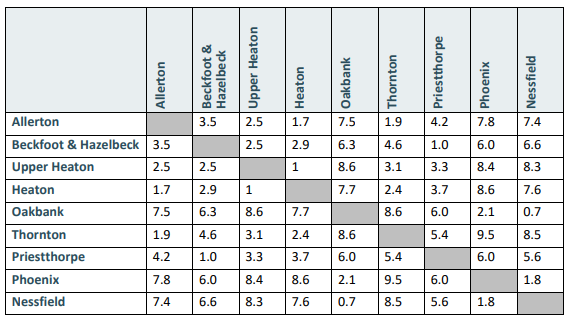

4.1.7 For journeys between Trust schools, all employees should use the mileage matrix below.

For cluster staff, no milage may be claimed for travel within the cluster however the below matrix can be used for journeys outside the cluster.

4.1.8 Reasonable, necessary parking charges will be reimbursed providing a receipt is obtained.

4.2 Vehicle insurance

4.2.1 Employees who use a private vehicle for school business should ensure that they have an insurance policy that covers use for business. Use limited to ‘Social, Domestic and Pleasure’ will not cover any journey in connection with work use. Expenses/Mileage claims will not be paid without the production of a valid insurance certificate demonstrating this.

4.2.2 In the absence of a valid insurance certificate, the journey should not be made by car and a claim may be made for the equivalent second-class class train or bus fare to the destination.

4.2.3 Employees must ensure that their vehicle is safe and legal to drive.

4.3 Use of public transport

4.3.1 The use of public transport for eligible journeys will be reimbursed upon receipt.

4.3.2 Employees should use the most economical class of travel and only the cost of second-class rail fare or bus fare will be reimbursed. Employees may opt to travel first class and pay the difference in cost, this will be via invoice and evidence of the difference in cost must be submitted.

4.3.3 The Trust will not pay for the travel of any accompanying person unless their attendance is required as a representative of the school/central team or the employee requires assistance by means of reasonable adjustments.

4.3.4 If intending to travel by rail, tickets should be booked well in advance. Please note purchasing rail tickets within a week of travel is significantly more expensive.

4.3.5 Bookings may be made with appropriate line management authority via the finance team or using a local school based Multipay card.

4.4 Overnight subsistence allowances

4.4.1 Reasonable expenses for the cost of accommodation, food and drink will be reimbursed when supported by receipts.

4.4.2 Overnight stays should be booked well in advance via the finance team using the purchase order system wherever possible or paid via Multipay card where appropriate.

4.4.3 Only the cost of accommodation required for business purposes will be reimbursed. The Trust will not meet the cost of additional parties or accommodation provided to a spouse or other family members.

4.4.4 Personal items, such as alcoholic drinks, mini bars etc. will not be reimbursed and their total should be deducted from any bills submitted for expenses purposes.

4.4.5 The prices below are intended as a guide and in general should not exceed the below limits. Where there are specific circumstances meaning it is not possible to find a room within the price limits below, the Trust will bear the cost if appropriate authority is sought in advance from a senior member of staff.

- London – up to £250.00 per night Bed & Breakfast

- Outside London – up to £140.00 per night Bed & Breakfast

4.4.6 When staying away from home the following claims may be made for food:

- Breakfast (leaving home before 6.30am, if not included in as part of an overnight stay) – up to £10.00

- Lunch – up to £10.00

- Evening meal (return or work beyond 8pm) – up to £15.00

4.5 Telephone and mobile expenses

4.5.1 Business calls made from a home telephone or personal mobile may be reimbursed subject to provision of an itemised telephone bill and their inclusion on the expense claim form.

4.5.2 Line or equipment rental will not be reimbursed.

4.6 Staff uniform

Employees should seek authorisation before purchasing specific uniform but once approved should submit an expense claim form with receipts. They will be reimbursed the lower of the full amount of the purchase cost or the limit specified below.

| Items | Upper limit of claim |

| Swimming costumer | £20 |

| Other uniform items | Cluster business manager’s discretion |

4.7 Spectacle contribution

Should an employee require glasses for use with DSE, the Trust will pay up to £50 towards the cost of glasses (including the eye test) required for DSE use. Line Managers should deem as eligible according to the criteria below.

- use of display screen equipment for continuous or near continuous spells of an hour or more at a time AND use it more or less every day, AND be highly dependent on DSE; or have little choice about using it; or need special training or skills to use it; or have to transfer information quickly; or need to apply high levels of attention and concentration

- completes the Optician DSE Eye Test Form

4.8 Other expenses

Reasonable out of pocket expenses will be met for costs incurred whilst on Trust business. A receipt should be provided however there is acknowledgement that this is not always possible. Where a reasonable attempt has been made to obtain a receipt, but it has not been possible to do so, proof of payment e.g., bank statement with the expense, or other evidence may be used in place of a receipt.

4.9 Exclusions

The following Items will not be reimbursed either because they are in contravention of the Academy Trust Handbook or because they would be counted as a taxable benefit:

- Alcohol

- Gratuities

- Travel to an employee’s designated place of employment

- Speeding or parking fines

4.10 Advances

In special circumstances, advances may be made for expenses over £100 but less than £1,000. Any advance must be cleared by producing an expense claim form as soon as reasonably practicable after the expense has been incurred and no more than one month after the advance was given.

4.11 Candidate expenses

Whilst it is not usual practice, prospective candidates attending an interview may be reimbursed reasonable travel costs at the discretion of the Headteacher or Executive Leader of the Trust.

4.12 How to claim

- Claims should be submitted by email using the Beckfoot Trust expense claim form to [email protected].

- Appropriate receipts should be attached, legible scanned copies are acceptable.

- The expense claim form should be authorised by the claimant’s line manager before being submitted.

Expenses will be paid via BACS into the employee’s bank account. The finance team may need to get in touch to check bank details.

4.13 Trustee and committee member expenses

4.13.1 It is the Trust intention that Trustees and LSC members should be able to play a full part in the governance of the Trust and incidental expenses should not provide a barrier to full participation. Trustees and LSC members therefore can and should claim allowances in respect of actual expenditure incurred whilst attending meetings of the Trust Board and its committees, undertaking development, and otherwise acting on behalf of the Trust Board. Trustees and LSC members may not claim for actual or potential loss of earnings or income.

All Trustees and LSC members are eligible to claim allowances in accordance with the points below:

| Category of expense | Rate/limit of claim |

| Childcare or baby-sitting expenses, where these are not provided by a relative or partner. Care arrangements for an elderly or dependent relative, where these are not provided by a relative or partner | Actual costs incurred, up to a maximum of £12 per hour |

| Support for Directors with special needs | Actual costs incurred |

| Support for Directors whose first language is not English | Actual costs incurred |

| Telephone calls and postage | Actual costs incurred |

| Travel – own vehicle | 45p per mile for cars and vans and 24p per mile for motorcycles |

| Travel – public transport/taxi | Actual cost incurred. However, where more than one class of fare is available, the rate shall be limited to second-class fares. For travel by taxi the cost must be reasonable |

| Subsistence | If additional expenses are incurred because work as a Trustee/Committee member requires taking meals (i.e., breakfast, lunch or dinner) away from your school area, reimbursement will be made for the food/drink items bought on the day claimed |

4.13.2 Trustees/LSC members should submit claims to the Finance Team via email using the expenses claim form available on the Trust Governance SharePoint as soon as possible after the expense is incurred (see 4.12 How to Claim bullet 1 and 2). The Finance Team will then seek authorisation for payment of the expenses from either the CFO, COO or CEO.

4.13.3 Receipts must be supplied to support claims for reimbursement, e.g., bus ticket, phone bill, taxi receipt, till receipt. A fuel VAT receipt must be submitted for mileage expenses claimed to allow the Trust to reclaim VAT. In the case of telephone calls, an itemised phone bill should be provided, identifying the relevant calls.